(a) The area designated as Community Reinvestment Area No. 3 constitutes an area in which new construction or repair of existing residential, commercial, and industrial properties has been discouraged.

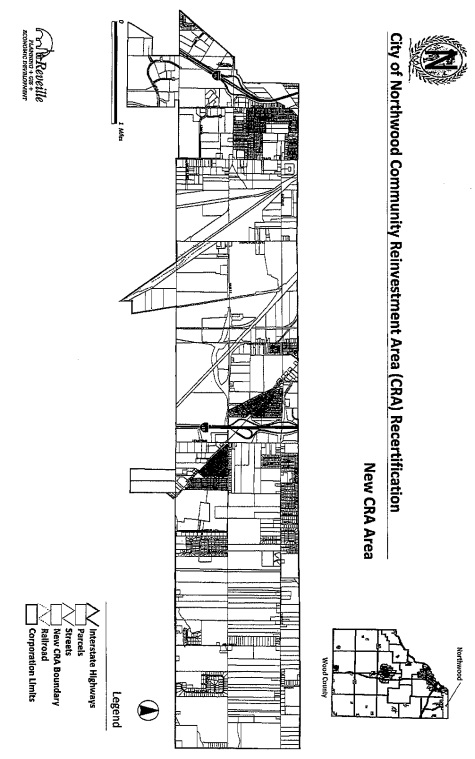

(b) Pursuant to Ohio R.C. 3735.66, CRA No. 3 is hereby established in the area delineated by a boundary as indicated on the map designated as Exhibit A following this chapter.

(c) All properties identified in Exhibit A within the designated CRA are eligible for this incentive. Only residential, commercial, and industrial properties consistent with the applicable zoning regulations within the designated CRA No. 3 will be eligible for exemption under this program.

(d) Within the CRA, the percentage of the tax exemption on the increase in the assessed valuation resulting from improvements to commercial and industrial real property, and the term of those exemptions, shall be negotiated on a case-by-case basis in advance of construction or remodeling occurring, according to the rules outlined in Ohio R.C. 3735.67. For residential property, a tax exemption on the increase in the assessed valuation resulting from the improvements as described in Ohio R.C. 3735.67 shall be granted upon proper application by the property owner and certification thereof by the designated Housing Officer for the following periods. The results of the negotiations as approved by the City Council will be set in writing in a CRA Agreement as outlined in Ohio R.C. 3735.671.

(1) The terms are as follows:

A. Twelve years for the remodeling of residential dwelling units containing not more than two housing units and upon which the cost of remodeling is at least twenty-five hundred dollars ($2,500), as described in Ohio R.C. 3735.67, and with such exemption being 100% for each of the twelve years.

B. Twelve years for the remodeling of residential dwelling units containing more than two housing units and upon which the cost of remodeling is at least five thousand dollars ($5,000), as described in Ohio R.C. 3735.67, and with such exemption being one hundred percent (100%) for each of the twelve years.

C. Fifteen years for the construction of residential dwellings, as described in Ohio R.C. 3735.67, with such exemption being one hundred percent (100%) for each of the fifteen years.

D. Up to twelve years, and up to one hundred percent (100%) for the remodeling of existing commercial and industrial structures and upon which the cost of remodeling is at least five thousand dollars ($5,000), as described in Ohio R.C. 3735.67, the term and percentage of which shall be negotiated on a case-by-case basis in advance of remodeling occurring.

E. Up to fifteen years, and up to one hundred percent (100%) for the construction of new commercial and industrial structures, the term and percentage of which shall be negotiated on a case-by-case basis in advance of construction occurring.

(2) If remodeling qualified for an exemption, during the period of the exemption, the dollar amount of the increase in market value of the structure shall be exempt from real property taxation. If new construction qualifies for an exemption, during the period of the exemption, the structure shall not be considered to be an improvement on the land on which it is located for the purpose of real property taxation.

(e) All commercial and industrial projects are required to comply with the State application fee requirements of Ohio R.C. 3735.672 (C) (Seven hundred fifty dollars ($750) to the Treasurer, State of Ohio). A local annual monitoring fee of one percent (1%) of the amount of the incentives, or a minimum of five hundred dollars ($500), up to a maximum of twenty-five Hundred Dollars ($2,500) annually is required for commercial and industrial projects.

(f) To administer and implement the provisions of this Resolution, the City Administrator is designated as the Housing Officer as described in Ohio R.C. 3735.65 through 3735.70.

(g) A "Community Reinvestment Area Housing Council" shall be created, consisting of two members appointed by the Mayor, two members appointed by the City Council, and one member appointed by the Planning Commission. The majority of the members shall then appoint two additional members who shall be residents within the area. Terms of the members of the Council shall be for three years. An unexpired term resulting from a vacancy in the Housing Council shall be filled in the same manner as the initial appointment was made.

(h) The City Council reserves the right to re-evaluate the designation of CRA #3, at whicn time Council may direct the Housing Officer not to accept any new applications for exemptions as described in Ohio R.C. 3735.67.

(i) The CRA Housing Council shall make an annual inspection of the properties within the district for which an exemption has been granted under Ohio R.C. 3735.67. The Housing Council shall also hear appeals under Ohio R.C. 3735.70.

(Res. 2013-6. Passed 10-14-13.)

(Res. 2013-6. Passed 10-14-13.)